CEO's Message

The $1 billion milestone represents an expansion of our mission and our ability to invest, share our knowledge and resources, and create an impact in communities where it’s needed most.

CPC continued to expand and elevate our impact in FY 22, lending and investing a landmark $1 billion in neighborhoods across the United States.

CPC’s mission-driven work across our construction and permanent lending, mortgage lending, and equity investing platforms and through initiatives and programs financed 144 transactions totaling 9,638 units in 12 states. Each project advanced CPC’s impact goals of expanding the affordable housing stock, investing in the green economy, and reducing the racial wealth gap.

More than 95% of the total units financed were affordable to households earning at or below 120% area median income (AMI), with more than 80% of the units being affordable to households earning at or below 80% AMI.

CPC’s $1 billion lending and investing represented an increase in revenue and growth across CPC’s business lines, which included $412 million in construction lending originations, $560 million in Agency mortgage originations, $33 million in permanent lending originations, $25 million in real estate equity investments, and $3.5 million in investments through the company’s mission-focused Impact Investing platform.

FY22 also saw CPC expand its impact through its knowledge sharing, educational initiatives, impactful new partnerships, and a new philanthropy program. Looking ahead, CPC remains committed to channeling our capital, unique expertise, and policy voice toward creating more affordable, sustainable, and equitable communities.

in Lending and Investing

Loans and Investments

Units Created or Preserved

Affordable Units

Invested with BIPOC Developers

Sustainable Homes Financed

The $1 billion milestone represents an expansion of our mission and our ability to invest, share our knowledge and resources, and create an impact in communities where it’s needed most.

Rafael E. Cestero

Chief Executive Officer

Every dollar of that $1 billion represents a commitment to getting out into communities, making new partnerships, and finding new ways that CPC can make a difference.

We’ve grown and diversified the company through our traditional lending and investing, as well as through initiatives like ACCESS, Sustainability, and Connections that focus on equity, knowledge sharing, philanthropy, and community engagement. My thanks to our team at CPC, to our investors, government partners, and industry peers who are all a part of our success.

Sadie McKeown

President

CPC’s $1 billion in lending and investing resulted in unprecedented impact in the neighborhoods we serve.

Each one of the 144 transactions advanced CPC’s goals of expanding affordable housing, investing in the green economy, and reducing the racial wealth gap.

in construction lending

in Agency mortgage lending

in real estate equity investing

in permanent lending

in impact investing

CPC continues to believe that housing is central to transforming underserved neighborhoods into thriving communities. We are working to expand housing access and seek new ways to lower the cost of producing affordable housing.

To date, CPC has delivered financing for the creation or preservation of homes for more than one million people.

CPC financing supports construction and renovation of the sustainable, affordable, and workforce housing that neighborhoods need.

CPC’s national Agency lending business is bringing flexible capital to communities to expand and preserve affordable and workforce housing.

CPC’s Equity Investing platform provides mission-driven investments into the preservation and creation of high quality housing at affordable and workforce rents.

CPC is dedicated to doing our part in closing the racial wealth gap, and increasing diversity and equity in the development industry.

Through CPC ACCESS, CPC has invested more than $378 million with BIPOC developers.

CPC financing supports construction and renovation of the sustainable, affordable, and workforce housing that neighborhoods need.

CPC’s national Agency lending business is bringing flexible capital to communities to expand and preserve affordable and workforce housing.

CPC’s Equity Investing platform provides mission-driven investments into the preservation and creation of high quality housing at affordable and workforce rents.

CPC is committed to expanding our investment in the green economy and lessening the impact of climate change through our lending and investing in multifamily housing, and our knowledge-sharing and advocacy work.

To date, CPC has financed more than 10,000 energy-efficient homes.

CPC financing supports construction and renovation of the sustainable, affordable, and workforce housing that neighborhoods need.

CPC’s Equity Investing platform provides mission-driven investments into the preservation and creation of high quality housing at affordable and workforce rents.

Our talented team, commitment to mission and the strong partnerships we have built in the communities we serve continue to define CPC and elevate our impact.

CPC supported our nonprofit partners with $500,000 in philanthropic grants and came together for four corporate volunteer days connected to our mission and philanthropy work.

$1 Billion of Impact in Communities across the United States

Housing Units

CPC Consolidated Financial Highlights

Unaudited results for the 12 months ended June 30, 2022

| Net Assets | $251,075,206 |

| Revenues | $17,736,413 |

| Servicing Portfolio | $3,731,000,000 |

| Construction Loan Portfolio | $1,369,924,880 |

| Equity Portfolio | $60,143,798 |

| TOTAL ASSETS UNDER MANAGEMENT | $5,161,068,678 |

Thank you to our customers, partners, and talented team for a tremendous FY 22. In the year ahead, we look forward to meeting new challenges and embracing opportunities to make a positive impact in the communities we serve together.

1 Million

People Housed to Date

CPC continues to believe that housing is central to transforming underserved neighborhoods into thriving communities. We are working to expand housing access and seek new ways to lower the cost of producing affordable housing. To date, CPC has delivered financing for the creation or preservation of homes for more than one million people.

of Units Financed Affordable to Households Earning at or below 120% AMI

of Units Financed Affordable to Households Earning at or below 80% AMI

Small Buildings Financed

The New York State Homes and Community Renewal’s (HCR) Small Buildings Participation Loan Program (PLP) supports the redevelopment of vacant or underutilized small buildings into affordable, multifamily rental properties. Through this program, CPC has brought more than 200 units of affordable housing to neighborhoods in need.

With Legacy Cities Access, CPC and HCR are creating affordable, sustainable homeownership communities for low- and moderate-income homeowners, with a focus on first time homebuyers and households of color.

Another focus of CPC’s affordable housing work is our equity investments and policy efforts in support of the long-term preservation of the New York City Housing Authority’s (NYCHA) public housing, a critical resource of deeply affordable housing for more than 350,000 New Yorkers.

CPC’s Equity Investing platform provides mission-driven investments into properties, portfolios, platforms, and funds to preserve and create high quality housing at affordable and workforce rents.

As an equity investor, CPC provides long-term stability to the residents of its nearly 4,000 units of quality, affordable housing under ownership.

IN FY 2022

In FY22, CPC deployed $25 million in new equity investments and continued to steward the massive rehabilitation of a 38-building public housing portfolio that spans 16 properties in Manhattan and provides 1,718 units of deeply affordable housing to New Yorkers.

Whether the project is downtown revitalization, adaptive reuse, affordable and supportive housing, the acquisition and rehabilitation of distressed property, or new construction, CPC works closely with our customers and partners to make a positive impact in communities across New York and beyond.

IN FY 2022

CPC’s construction lending business originated

$412

million

in

48

affordable and workforce housing projects

CPC Mortgage Company, CPC’s national Agency lending business, is bringing flexible capital to communities to expand and preserve affordable and workforce housing.

In FY22, CPC Mortgage Company originated $561 million in Freddie Mac, Fannie Mae, and FHA/HUD mortgages across 11 states. CPC closed the year by bringing on Cinnaire and National Equity Fund as cooperative owners of the Agency lending business, alongside CPC.

The sector-defining partnership leverages the resources and expertise of its three nonprofit owners to increase access to Agency mortgage capital in neighborhoods where it is needed most.

32%

YoY volume increase in FY22

80%

of lending outside New York State

I’m proud of the CPC Mortgage Company team and what we’ve been able to accomplish.

Our growth and geographic expansion allows us to move the mortgage industry towards a place where we can ask the question, ‘where do we need to be to make the biggest impact?’

Whether it’s affordable, conventional, or small we look at every deal through a lens of impact and potential, and every borrower and every transaction has the ability to help us continue our work of investing in communities.

Troy, New York

$480,000

Construction Loan

Terrioma “Terri” Stephenson, a real estate investor and business owner, worked with CPC to complete her first gut renovation, paving the way for continued success in multifamily real estate development and ownership.

Born and raised in the Capital Region, Terri currently owns a two-family building as well as a daycare business in Brooklyn, NY. She took the next step in her real estate career alongside CPC and ACCESS, an initiative that empowers BIPOC real estate entrepreneurs and seeks to increase diversity within the development industry.

With a $480,000 CPC construction loan and technical assistance through CPC ACCESS, Ms. Stephenson successfully transformed a three-story walk-up building located in the Prospect Park/RPI area of Troy. The 1900s-era building now offers four newly renovated apartments to the community, which has recently seen an increase in development and demand for housing and is within walking distance of Russell Sage College, Washington Park and Prospect Park.

Dedicated and responsible small building owners like Ms. Stephenson play a critical role in neighborhoods across the United States; one building at a time, projects like this one create stability and economic opportunities for individuals and families who rely on rental housing.

Ms. Stephenson is in the process of relocating to Latham, NY, in close proximity to this building, and plans to continue expanding her real estate portfolio while creating a positive impact in the New York Capital Region.

$37.4M

Construction Loan

$37.4M

Permanent Loan

Wakefield Apartments is a supportive housing project for families overcoming homelessness and low-income households, and was the first affordable housing project to benefit from a pilot program to transition New York City's residential buildings to electric power.

This substantial rehabilitation project will revitalize two 1920s-era buildings in the Wakefield neighborhood of the Bronx, converting units formerly utilized as temporary shelter into 126 permanently affordable homes. Eighty-eight units will be available to formerly homeless households receiving rental assistance vouchers, with the remaining apartments available to households paying rents at or below 60% of the Area Median Income, or $72,000 for a family of three.

Nonprofit owner and developer Samaritan Daytop Village, a major social services provider in New York City, will support residents in maintaining residential stability and self-sufficiency through comprehensive on-site social service programs.

An energy retrofit of one, 54-unit building will partially electrify the development by replacing fossil fuel-based heating and cooling with highly efficient heat pump technology. These upgrades, which will increase energy efficiency, lower greenhouse gas emissions, and generate healthier indoor air quality, are being funded with $1 million through the New York City Department of Housing Preservation and Development (HPD)-NYSERDA Retrofit Electrification Pilot, a three-year pilot created to address the carbon footprint from buildings.

The development’s clean energy upgrades at both buildings will meet NYC’s Enterprise Green Communities standards and are expected to greatly benefit the residents' and buildings' physical health. This collaborative effort between New York City, New York State, CPC, and Samaritan Daytop Village is a meaningful investment in a population that rarely benefits from climate-change investments.

CPC and HPD provided a joint construction loan of $37.4 million dollars for the rehabilitation of these properties as well as $37.4 million in permanent financing that were combined with an additional $3.5 million provided by the New York State Homeless Housing Assistance Program. CPC provided $7.5 million in permanent financing through its partnership with the New York City Retirement System, managed by the New York City Comptroller’s Office.

Beacon, New York

$50.3M

Construction Loan

246 Units

Energy-efficient multifamily rental community

25

Affordable homes

The largest residential rental property to break ground in Beacon in decades, 22 Edgewater Place will be a 246-unit, energy-efficient multifamily rental community and will include 25 affordable homes.

The property is being constructed with sustainability as a focus, including employing high efficiency systems that eliminate fossil fuels for heating and cooling of the apartments. This will provide a healthier indoor environment for tenants.

CPC is providing $50.3 million in construction financing with its partners Salisbury Bank and Trust and Orange Bank and Trust.

With a view of the Hudson River, ample green space, and a location within walking distance of the Metro-North Train Station, the site advances CPC customer Rodney Weber’s vision for “homes that bring people closer to nature; and allow them to be refreshed by the beauty of our Hudson Valley.”

The construction of this development comes at a critical time when Beacon and other cities across New York are experiencing a crisis of housing availability and affordability. The most recent Dutchess County Housing Survey from 2020 reported market rate vacancy for the county at 0.9%, with a 0% vacancy for Beacon, and a 0.5% vacancy for affordable units county wide.

The project’s 25 affordable units will be below market-rate and affordable to households earning 70% of area median income. Planned amenities include parking, storage areas, roof top deck, outdoor seating, a library/co-working space, fitness center, and walking trails.

CPC has a long history of investing in the revitalization of Beacon’s downtown housing stock. Beginning in the early 1990’s CPC began working with the local government, property owners, and developers to invest in the area, which at the time was experiencing significant distress, including a high number of vacant properties. To date, the company has provided more than $115 million in financing for more than 25 multifamily projects in Beacon, providing quality housing for more than 600 residents.

Spring Valley, New York

$3.7M

Bridge Loan

$5.6M

Construction Loan

$2.6M

Permanent Loan

We are forever grateful for the interest CPC took in helping us save our home.

Residents of a low-income co-op were at risk of losing their homes as a result of mismanagement and illegal misuse of co-op funds by a fraudster and his accomplice who were hired, after misrepresenting their credentials, to help manage the finances and act as superintendent of the property. CPC joined forces with entities at the local and state level to prevent foreclosure and stabilize the property financially and physically.

When a resident’s complaint triggered an investigation, the New York State Office of the Attorney General (OAG) uncovered several instances of fraud over multiple years that had left the co-op building in financial distress, through no fault of its residents. CPC, together with the law firm Nixon Peabody, the OAG, and New York State Homes and Community Renewal (HCR) came together with support from the Rockland Housing Action Coalition to preserve and stabilize the property.

CPC provided a $3.7 million bridge loan to pay off the co-op’s underlying debt and associated fees, ensuring that it would avoid its scheduled foreclosure auction and allowing the partnership to move forward with preservation efforts.

For rehabilitation work, CPC provided an additional $2.6 million in construction financing alongside $3 million in HCR Participation Loan Program (PLP) funds. CPC also provided $2.6 million in permanent financing through its partnership with the New York City Retirement System, managed by the New York City Comptroller’s Office.

Moderate rehabilitation work financed by CPC and HCR through the state’s Small Building Participation Loan Program will include roof replacement, safety upgrades, and HVAC repairs. As a result of the refinance and rehabilitation, all 54 homes will remain affordable to the shareholders and households earning no more than 120% of the Area Median Income.

The legal agreement reached with the OAG’s office required the bad actor and his collaborators to pay hundreds of thousands of dollars in penalties and restitution to the co-op, forced the property manager to resign, and permanently banned him from real estate development or financing activity in existing residential properties in New York.

Johnson City, New York

156

New market-rate loft apartments

$31.6M

In construction financing

The transformation of a historic industrial building in Johnson City, New York will create 156 new market-rate loft apartments.

The iconic Endicott-Johnson Victory Factory previously sat vacant for more than 40 years. With financing from The Community Preservation Corporation and additional partners, Paulus Development and LeChase Construction Services will transform this legacy site into an anchor for the community’s revitalization. The redeveloped Victory Building will recognize and celebrate the community’s historical importance in manufacturing while directly investing in the region’s fast-growing educational and medical economies.

The redevelopment of this previously blighted and underutilized site will help to improve the connection between Binghamton University’s Health Sciences campus, UHS Wilson Medical Center, and the area north of Main Street in Johnson City– paving the way for additional investments and opportunities within the Southern Tier Health Sciences and Technology Park. With rents projected to be affordable to households earning 89%-117% of area median income, this historic site will become a housing resource for the growing local workforce.

The climate friendly design includes electric car charging ports, energy efficient appliances and lighting, higher efficiency windows, upgraded storm water management systems, and new outdoor green spaces, which will significantly mitigate carbon emissions and deliver health and comfort benefits to residents.

CPC, NBT Bank, and PathFinder Bank are providing $31.6 million in construction financing. CPC is also committing $3.8 million in Brownfield Bridge financing, as well as $22.7 million in permanent financing. The project is receiving $9.7 million in Historic Tax Credit equity through Chase Community Equity, LLC. Broome County Local Development Corporation is providing $1.5 million in grant funding, and the Village of Johnson City and the Broome County IDA approved a PILOT and other tax exemptions to assist in the financing of the project.

The Endicott-Johnson Victory Shoe Factory was built in two stages in 1919 and 1920 for the Endicott-Johnson Shoe Company, one of the largest shoe manufacturers in the world responsible for nearly all the shoes and footwear for the U.S. Army during World War I and World War II. The “Victory” Factory was named to celebrate and commemorate the U.S. victory in World War I.

Various Sites, Michigan

$105.7 M

First Mortgage Financing and Subordinate Debt

Here you had a minority development company with the creativity and know-how to structure this portfolio located in its own ‘backyard’… I truly do believe these deals reflect the heart of economic and collaborative equality. Everyone has been an absolute pleasure to work with.

CPC Mortgage Company worked with Ginosko Development Company (GDC) and L+M Development Partners (L+M) on this $105.7 million transaction to advance the organizations’ shared goals of preserving and expanding access to affordable housing.

To support the acquisition and preservation of this 1,370-unit portfolio of affordable rental buildings, CPC Mortgage Company provided a total of $97.6 million in first mortgage financing through Freddie Mac’s Targeted Affordable Housing (TAH) product, along with $8.1 million of CPC subordinate debt on three of the properties.

A partnership between owners GDC and L+M will help preserve the long-term affordability and quality of the properties, which are located in the cities of Detroit, Saginaw, Walker, Center Line, Monroe, Canton, and Pontiac.

This acquisition underscores the commitment of the GDC, L+M and CPC Mortgage Company to address the housing needs of underserved communities, as well as the long-term preservation of affordability for low- and moderate-income tenants. All of the properties are affordable to households earning 60% of Area Median Income or below, with six of the properties benefiting from Housing Assistance Program (HAP) contracts. The portfolio will undergo moderate rehabilitation to address long-term maintenance needs, so that it continues to provide quality housing to residents.

GDC is one of the awardees of Citi’s Emerging Manager Fund, an initiative aimed at preserving affordable housing while expanding opportunities for diverse developers. A portion of the proceeds of this funding will allow GDC to fully capitalize the acquisition.

Los Angeles, CA

$29.5M

Portfolio Refinance

150+

New units of affordable housing in Los Angeles

CPC Mortgage Company partnered with SoLa Impact, a social impact real estate fund that focuses on preserving, renovating, and creating high-quality affordable and workforce housing in communities of color, to provide financing for the revitalization of their portfolio.

As part of the ongoing collaboration, CPC delivered $29.5 million in Freddie Mac Small Balance Loan program financing as well as a $3.7 million pre-development loan to help refinance and preserve more than 150 apartments in 22 buildings located in underserved communities throughout South Los Angeles.

The partnership between SoLa Impact and CPC Mortgage Company brings together two unique mission-driven organizations, an owner-investor and a lender, that each focus on creating a social impact through responsible investments in multifamily housing.

All of the units refinanced with SoLa are affordable to households earning 80% of the area median income (AMI) or below. Approximately 90% of the units will have tenant-based housing vouchers, serving the housing needs of the area’s most economically vulnerable residents.

SoLa Impact is Los Angeles’ largest Section 8 landlord and works with over 50 nonprofit organizations across Southern California to help place residents in the newly renovated and newly constructed high quality affordable housing units that SoLa Impact is adding to the South Los Angeles housing supply. SoLa Impact is currently underway deploying more than $1B for the construction of 4,000 new units of affordable housing in Los Angeles.

New York, New York

1,036 Units

Ensuring long-term affordability and stability for residents who call these developments home.

13

Buildings

10

Properties

CPC’s equity investment alongside fellow mission-driven organizations for the purchase and preservation of this 13-building, 1,036 unit portfolio is ensuring long-term affordability and stability for residents who call these developments home. The 13 buildings are located on 10 properties that were developed by the Dunn Development Corp., and are located in Manhattan, the Bronx, and Brooklyn.

In addition to CPC, mission-driven nonprofit and for-profit companies with decades of experience in affordable housing finance, construction, maintenance, and management make up the ownership team, including; The Community Development Trust, Monadnock Development, Red Stone Equity Partners, and the Black Developers Network Triboro.

Comprised of newly built, high-quality affordable apartments, the properties’ rents will remain income restricted, primarily at levels affordable to residents earning at or below 60% of area median income. Many of the buildings also offer on-site supportive services to enable vulnerable populations to live independently and thrive.

Ownership that is dedicated to affordable housing preservation can help guard against gentrification, reduce displacement, and contribute to the stability and revitalization of communities.

In keeping with Dunn Development’s focus as a socially conscious, mission-forward company, a majority of the proceeds from the transaction will be used to capitalize a new charitable organization, the Blue Sky Social Justice Fund.

$378 Million

Invested with BIPOC Developers to Date

CPC is dedicated to doing our part in closing the racial wealth gap, and increasing diversity and equity in the development industry. Through CPC ACCESS, CPC has invested more than $378 million with BIPOC developers.

Since the creation of CPC ACCESS in August 2020, commitment across the company has resulted in 60 investments with BIPOC developers totaling more than $378 million.

When BIPOC developers have the opportunity to grow and compete in the market, we’re not just leveling the playing field. We’re bringing new ideas, better competition, and diversity to the benefit of the entire industry.

Investments with BIPOC Developers totaling more than $100 Million

ACCESS Incubator Training Graduates

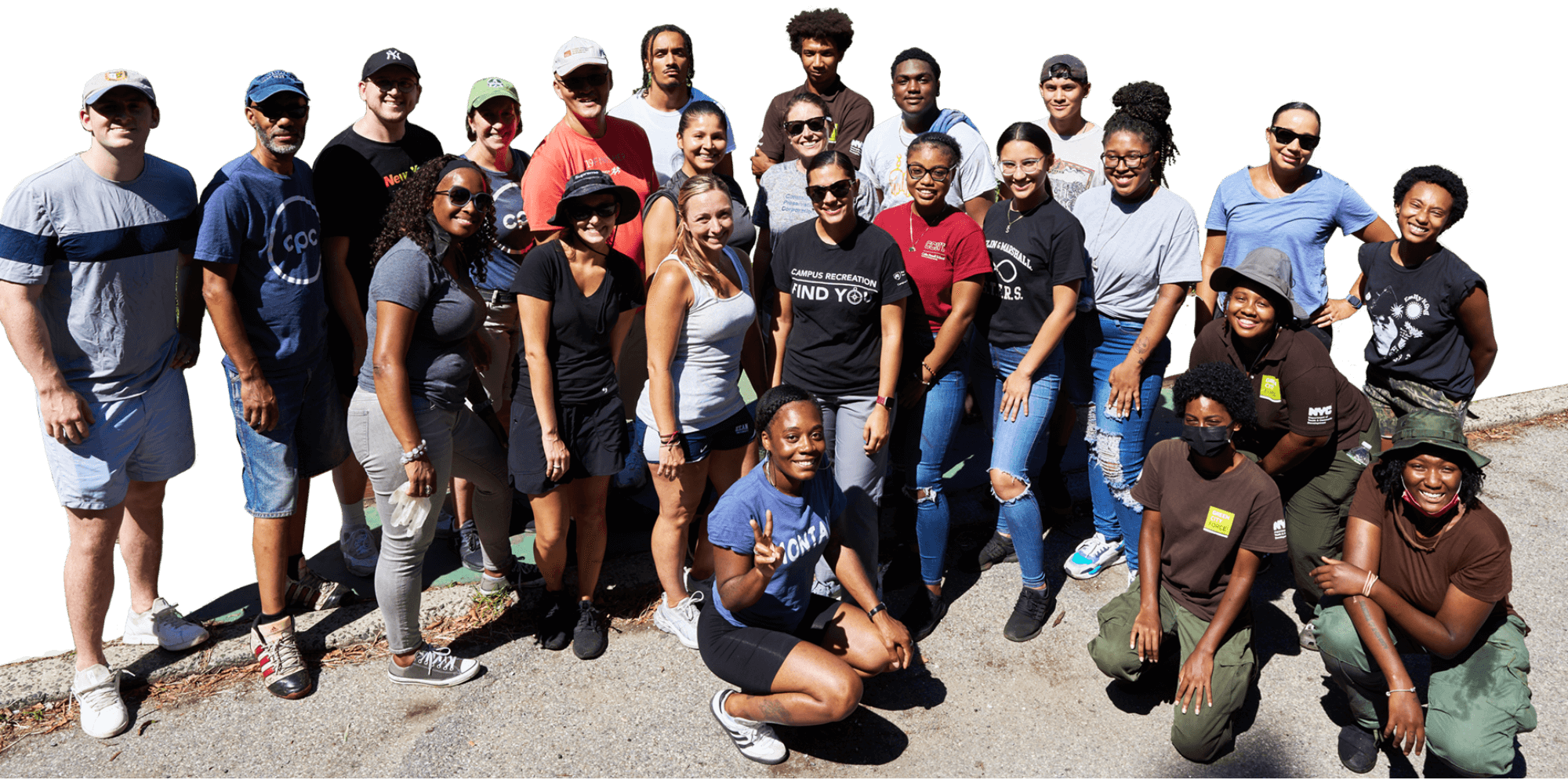

The CPC ACCESS Incubator, a real estate training program for BIPOC entrepreneurs, launched in FY22 and graduated its first cohort of 20 participants. The training equips novice and emerging developers with knowledge and resources to navigate each step of the multifamily real estate development process.

Through a joint venture with TruFund Financial Services, CPC is investing affordable capital and technical assistance to empower emerging BIPOC housing developers to grow their businesses. The fund’s first investment in Infinite Horizons, LLC, will support the company’s strategic growth plan and grow their capacity to develop and manage affordable housing. The fund’s first investment in Infinite Horizons, LLC, will support the company’s strategic growth plan and grow their capacity to develop and manage affordable housing.

The Legacy Cities Access program with New York State Homes and Community Renewal is supporting M/WBE developers and creating affordable homeownership opportunities, with a focus on first-time homebuyers and BIPOC households.

10,000

Energy-efficient Homes

CPC is committed to expanding our investment in the green economy and lessening the impact of climate change through our lending and investing in multifamily housing, and our knowledge sharing and advocacy work. To date, CPC has financed more than 10,000 energy-efficient homes.

In FY22, CPC, The Federal Reserve Bank of New York (NY Fed), and the New York State Energy Research Development Authority (NYSERDA) convened multifamily stakeholders, bringing developer, finance, and other expert perspectives front and center in the NY Fed’s Sustainable Affordable Housing white paper. The new publication recommends financing strategies for an equitable clean energy transition for New York’s affordable housing stock, with contributions from CPC experts including CPC President Sadie McKeown.

CPC made a $500,000 equity investment through our Impact Investing platform in Bright Power, a leader in completing deep energy retrofits for multifamily housing in New York with a significant concentration in affordable housing. CPC’s investment was part of a $25 million round of funding that will position Bright Power to grow, expand its energy efficiency impact in the real estate industry, and simultaneously advance CPC’s sustainability goals.

Sustainable Units Financed

CPC closed FY22 with a successful application to administer $250 million in New York State funding for electrification retrofits.

Through the Climate Friendly Homes Fund, CPC and New York State Homes and Community Renewal (HCR) aim to electrify at least 10,000 units of multifamily housing serving economically disadvantaged communities.

CPC is committed to supporting external partners beyond our traditional debt and equity investing and internally connecting staff to our mission and the communities we serve.

CPC awarded $500,000 in philanthropic grants to mission-aligned nonprofit organizations, came together for four corporate volunteer days connected to our mission and philanthropy, and formalized knowledge sharing efforts with trainings and webinars. The new CPC ACCESS Incubator training advanced our commitment to closing the racial wealth gap with an eight-week training series designed to empower BIPOC entrepreneurs to succeed in real estate development careers.

CPC awarded $500,000 to 10 nonprofit organizations operating in CPC’s markets and working to address issues related to closing the racial wealth gap or creating more sustainable communities.

Congratulations FY22 CPC Connections Grantees

To celebrate the end of the Fiscal year, our team joined inaugural CPC Connections grantee Green City Force for a volunteer day at one of their Eco-Hubs, located at Wagner Houses, a New York City Housing Authority (NYCHA) development. The urban farm provides fresh produce to 4,706 residents and is operated by young NYCHA residents in the Green City Force AmeriCorps service and training program.

The CPC team is dedicated to giving back to communities in and out of the office. In FY22, the CPC team came together for four corporate volunteering days connected to our mission and philanthropy through CPC Connections.

On Earth Day, volunteers prepped a McCarren Park demonstration garden in Brooklyn for student visitors and built garden bed kits to be distributed to GrowNYC green spaces throughout New York City.

Staff members also joined our PACT Renaissance Collaborative partners to give out Thanksgiving turkeys and collect, wrap, and distribute holiday gifts for residents of the 1,718-unit New York City public housing portfolio that CPC and partners are renovating, managing, and preserving.

CPC celebrated Earth Day with a volunteer event in Brooklyn’s McCarren Park, where we prepped a demonstration garden for spring visitors and built garden bed kits to be distributed to GrowNYC green spaces throughout New York City!

With education and outreach, CPC continues to foster the implementation of policies and programs that advance the idea that housing is central to transforming underserved neighborhoods into vibrant and thriving communities. Our policy team sets priorities at the federal, state, and local government level and works to realize our goals to promote social equity, diversity and sustainability within the housing industry.

CPC believes that The New York City Housing Authority’s (NYCHA) public housing is a critical resource of deeply affordable housing and we stand as a partner to government in working towards solutions for the long-term preservation of NYCHA. We continue to speak out regarding the need to preserve the city’s public housing stock, more than 70% of which is at least 50 years old.

CPC published Ending the NYCHA Blame Game, a policy paper identifying three strategies for the long-term preservation of NYCHA’s housing:

a bill establishing The Trust for Public Housing passed the New York State Legislature and was signed into law by Governor Kathy Hochul, creating the first public process to preserve public housing in the nation. CPC continues to advance the dialogue on this and other investments into public housing infrastructure.

At CPC, our people are our greatest asset. In FY22, we invested in our vibrant culture by creating new opportunities for our team to grow, learn and connect with each other, our mission, and the communities we serve. Part of this work included a new employee mentorship program and an expanded internship program. The summer 2022 internship class was the largest and most diverse to date.

CPC is dedicated to creating a culture of belonging for all employees. As a continuation of the commitment we made in the summer of 2020 to examine and elevate our Diversity, Equity and Inclusion efforts, we partnered with an external consultant in FY 2022 to develop a new DEI strategy informed by feedback from our employees.

Our DEI Strategic Plan includes making investments in the culture that our employees want to have, developing inclusive leaders, and creating internal employee communities in which our diverse team members can feel connected to one another as well as the underrepresented communities that we serve. Looking ahead, we will invest in dedicated resources to execute on our strategic plan. Our new DEI Vision Statement guides our ongoing work:

At CPC, we believe that diversity, equity and inclusion is collective work that must be undertaken by all CPC employees. It is our responsibility, as a company, to invest in the policies and practices needed to facilitate more empathetic and inclusive ways of working with our partners, within our communities, and with each other. By focusing on greater learning and education, we aim to increase transparency, accountability, and psychological safety; creating a more inclusive culture where all team members feel included and supported.

Our dynamic culture, successful business, and deep impact in communities are defined by our talented team and their commitment to advancing CPC's mission and living our values.

We Recognize the Following Leaders with Immense Gratitude for Careers of Distinguished Service to CPC and our Mission

Rick Kumro, Executive Vice President, General Counsel & Secretary - 34 Years of Service

Thomas McGrath, Senior Vice President and Director of Upstate Revitalization - 31 Years of Service

Operating Committee

Chief Executive Officer

President

Executive Vice President

Chief Operating Officer

President

CPC Mortgage Company

Executive Vice President

General Counsel & Secretary

Executive Vice President

Chief Financial Officer

Senior Vice President

Operations (Interim)

Senior Vice President

Director of ACCESS

Senior Vice President

Chief People Officer

Senior Vice President

Investments & Acquisitions

Senior Vice President

Chief Credit Officer

Senior Vice President

Chief Investment Officer

Senior Vice President

Strategic Communications and Community Engagement

Chief of Staff

Vice President, Policy & Advocacy

* Started at CPC in July 2022

CPC Honors the Following Board Members for their Guidance, Commitment, and Immeasurable Impact, With Grateful Appreciation for Service through December 2022

Bruce A. Beal, Jr. – 10 Years of Service

Todd A. Gomez – 13 Years of Service

Alan Wiener – 10 Years of Service

CPC Board Chair

Managing Director

Wells Fargo Multi-family Capital

CPC Board Vice Chair Managing Director, Acquisitions

Red Stone Equity Partners, LLC

President, Related Companies

Managing Director and Global Head of Real Estate and Asset Finance,

Credit Suisse

Faculty Director,

NYU Furman Center for Real Estate and Urban Policy

Senior Vice President,

Bank of America

Senior Advisor (Ret.),

CCMP Capital Advisors, LLC

Real Estate/Legal Consultant

Senior Vice President – Multifamily Chief Credit Officer (Ret.),

Fannie Mae

Managing Director, Affordable Housing Acquisitions & Development,

Tishman Speyer

CEO and President, Chemung Canal Trust Company

President, Capital Bank

Partner

Cannon Heyman & Weiss, LLP